Who is: Grupo Financiero CAFSA

Who is: Grupo Financiero CAFSA

Grupo Financiero CAFSA is a leading entity in the Costa Rican market with over 40 years of experience in the financial sector. It is part of the Grupo PURDY and specializes in the financing and leasing of personal, business, and work vehicles. Founded in 2001, the company has evolved to offer a wide range of financial services, ranging from pawn loans to operating leases.

In terms of size and scope, Grupo Financiero CAFSA has a workforce distributed between Financiera CAFSA and Arrendadora CAFSA. In terms of assets, Grupo Financiero CAFSA manages around USD 300 million in assets, of which close to USD 250 million corresponds to the credit portfolio.

The Challenge

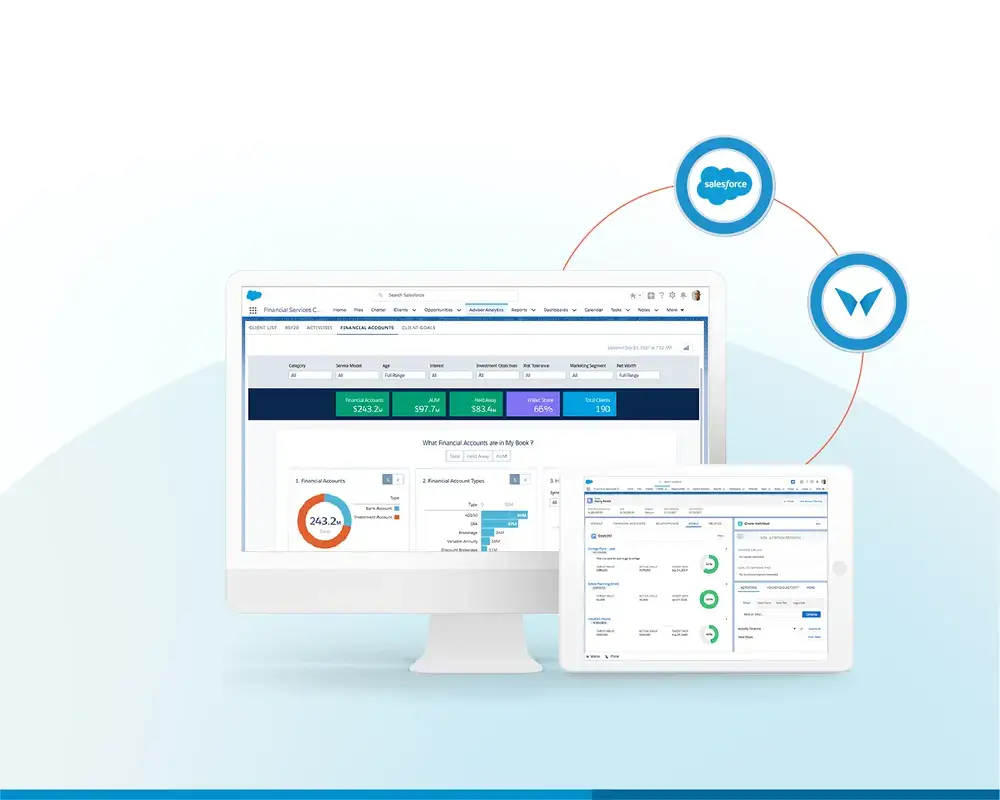

Prior to the implementation of Financial Services Cloud, CAFSA faced a significant challenge: its business process was dispersed across multiple platforms, making it difficult to obtain a complete view of its customers. At Freeway, we identified this challenge as an opportunity to provide a comprehensive solution that would enable efficient management and an exceptional customer experience.

Salesforce Financial Services Cloud: The Comprehensive Solution

In addition, Salesforce Financial Services makes it easy to automate key processes in the financial sector, such as account management, loans, cards, investments, and insurance. With specific functionalities for tracking financial goals,managing customer life events, and personalized action plans, this platform becomes a strategic ally for boosting operational efficiency and personalized customer service.

How Financial Services Cloud Works and How It Will Help CAFSA

With its recent implementation, Salesforce’s financial services cloud provides CAFSA with a complete view of each customer, including financial information, past interactions, contracted financial products, and more. This allows CAFSA’s sales and after-sales teams to offer personalized and efficient service at every stage of the customer lifecycle.

Some of the key features of Financial Services Cloud that benefit CAFSA include:

- 360° Customer View: Integration of financial information, past interactions, contracted products, and more into a single platform.

- Process Automation: Creation of automated sales and after-sales processes for efficient operations management.

- Legacy Systems Integration: Seamless connection with CAFSA’s legacy systems for unified information management.

The Implementation and Collaboration Process

The Implementation and Collaboration Process

The Salesforce implementation was carried out in an agile manner, allowing for the gradual incorporation of priority functionalities and close collaboration between Freeway and the CAFSA team. Regular follow-up meetings were established to ensure alignment of objectives and proactive resolution of any challenges that arose along the way.

Results and Impact

Thanks to the implementation of Salesforce Financial Services Cloud, CAFSA aims to achieve greater efficiency in customer management, offering more personalized and agile service.

In addition, they expect to improve the productivity of their teams by automating tasks and processes, which will allow them to focus on strategic activities for business growth.

In terms of concrete results, customer satisfaction has increased and retention and loyalty rates have improved. These achievements support the positive impact that Financial Services Cloud has had on CAFSA’s operations and overall performance.

Success Story in Latin America with Financial Services Cloud

Success Story in Latin America with Financial Services Cloud

Salesforce’s Financial Services Cloud tool is a powerful resource that benefits financial companies by improving their efficiency, offering personalized service, and adapting agilely to market demands.

Freeway’s successful implementation of Salesforce Financial Services Cloud has enabled Grupo Financiero CAFSA to stand out as a leader in its industry, highlighting its commitment to operational excellence and customer satisfaction.

At Freeway, we maintain a close collaboration with Salesforce in various countries such as Mexico, Costa Rica, Chile, Colombia, and Peru. In addition, we are grateful for the trust they have placed in us. This success story drives us to continue building a path of digital transformation in the financial sector.